The Rise of Centralization in Multifamily

The multifamily sector experienced unprecedented growth during the pandemic as lifestyle shifts and a national housing shortage pushed rents up and encouraged many owners and operators to expand their portfolios. Now, several years post-pandemic, the market has experienced a correction – large waves of new supply in many markets have outpaced demand, and rent growth has slowed across the country. These dynamics, coupled with general economic uncertainty, have multifamily owners and operators looking internally to create value and boost their net operating income (NOI), and technology that drives centralization is a top priority.

Many owners have been using solutions that streamline leasing, resident communications and engagement, and marketing for some time now, but there is an increasing demand for technology to optimize every aspect of property management. This includes things like maintenance and repairs, which are typically quite cumbersome and often require time-consuming coordination between onsite staff, vendors, and residents. For owners and operators of large apartment portfolios, each month brings thousands of new work orders and hundreds of new turns, presenting an extremely complex maze of to-dos for property teams that can be costly if not handled efficiently.

Optimizing the Maintenance Management Process

As the industry continues to move toward centralization, RET is committed to investing in companies that leverage sophisticated technology to drive efficiency across all management processes – including maintenance. It is this objective that led to our most recent investment in SuiteSpot.

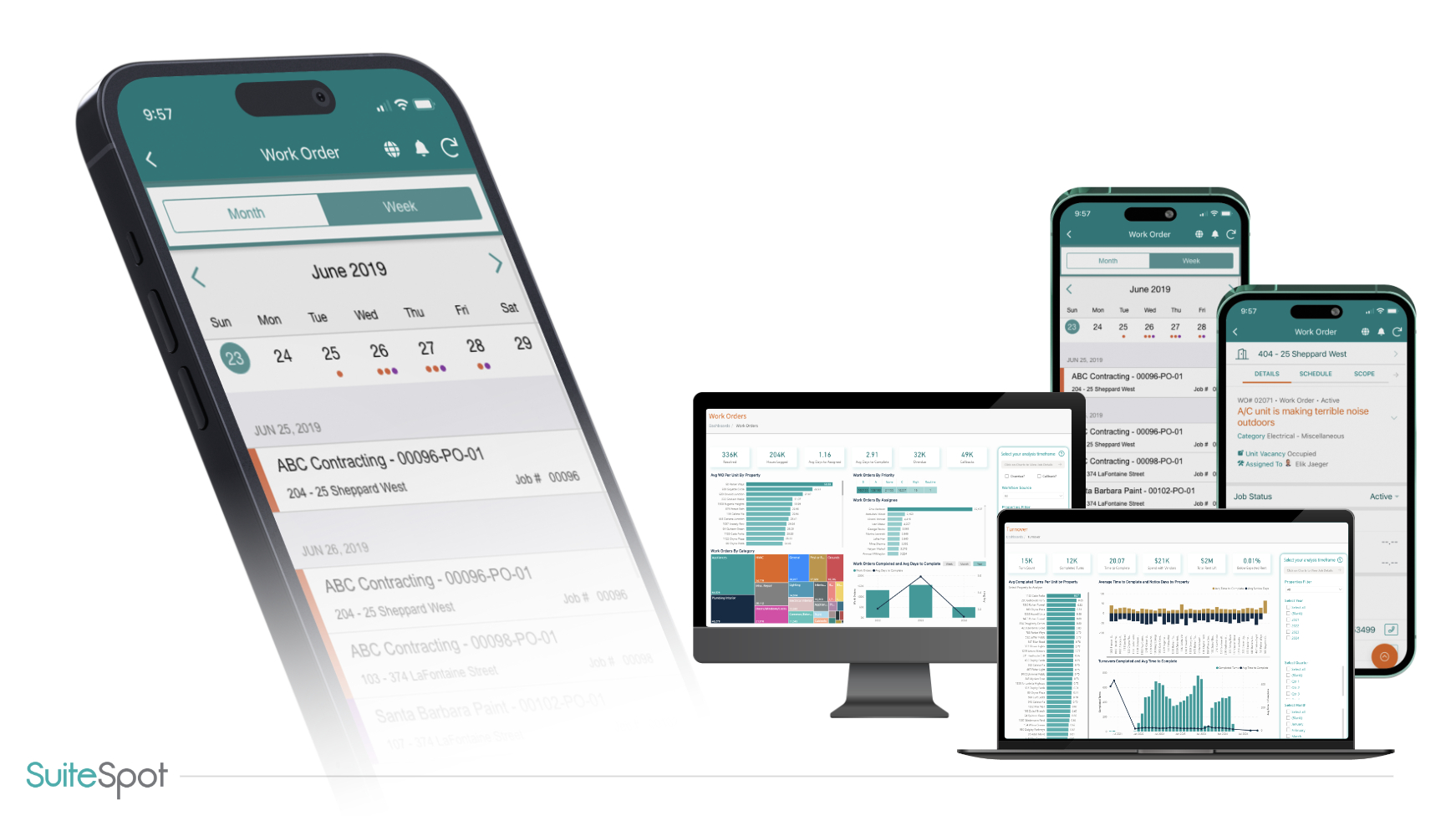

Originally developed to streamline and improve multifamily maintenance management, SuiteSpot’s platform has evolved to help property owners and operators centralize every aspect of maintenance and capital operations at scale. The platform leverages artificial intelligence (AI) to help property owners and managers complete maintenance and capital projects like make-readies and unit turns in an efficient, cost-effective manner, helping them get vacant units back to market as quickly as possible. The entire maintenance workflow, from work order origination and execution, to vendor management and resident engagement, is facilitated through the SuiteSpot app.

SuiteSpot also collects property data so management can easily track key performance indicators (KPIs), including average turn time and budget usage. Using SuiteSpot, owners of geographically dispersed portfolios can compare performance across their properties and gain insights into future spend. The platform also reduces risk for property owners by tracking progress on preventative maintenance and compliance as well as incident reporting.

Critically, SuiteSpot integrates with RET portfolio company, Funnel, and other leading real estate tech tools, creating an optimal experience by fitting seamlessly within the existing workflow stack.

SuiteSpot’s Core Value

SuiteSpot’s solution is powerful, and it has already experienced significant traction in the market. The platform is currently tracking to be deployed across 500,000 rental units, and users have reported significant improvements to maintenance processes with clear in-year ROI, including up to 50% reduction in apartment turn times and 40% faster work order completion times.

As multifamily owners continue to prioritize technology that improves and centralizes key operations like maintenance, SuiteSpot will remain an indispensable solution for stakeholders looking to boost their NOI. For many of its users, SuiteSpot is fast becoming an indispensable technology tool, and it’s an exciting new addition to the RET portfolio.