Data is King

In recent years, big data has emerged as an important tool for guiding operational efficiencies and driving increased ROI across all business sectors — and real estate has been no exception. From uncovering granular geographic insights to fine-tuning risk analysis and mitigation and beyond, the application of data in the real estate industry has propelled significant, market-wide improvements.

As the single-family rental (SFR) sector continues to gain momentum ($50 billion of capital is chasing SFR, more than a tenfold increase since 2020), industry experts are increasingly interested in how the practice of leveraging data-backed insights can improve operations for institutional investors throughout SFR. Many SFR investors are new to the sector, and are grappling with the reality that the complexities of acquiring and managing SFR properties is different than those associated with the multifamily complexes that have traditionally received the bulk of institutional capital. While operating in this unfamiliar territory, investors are increasingly looking for tools that will give them access to datasets and data science that supports the intelligent deployment of their capital. Enter, Picket Homes.

Transforming the SFR Experience for Investors and Renters

RET Ventures’ recent role in leading Picket’s Series A round is the latest in the firm’s ongoing investment efforts focused on rent tech solutions for the SFR market, demonstrated by previous investments made earlier this year in platforms such as Lula and Azibo.

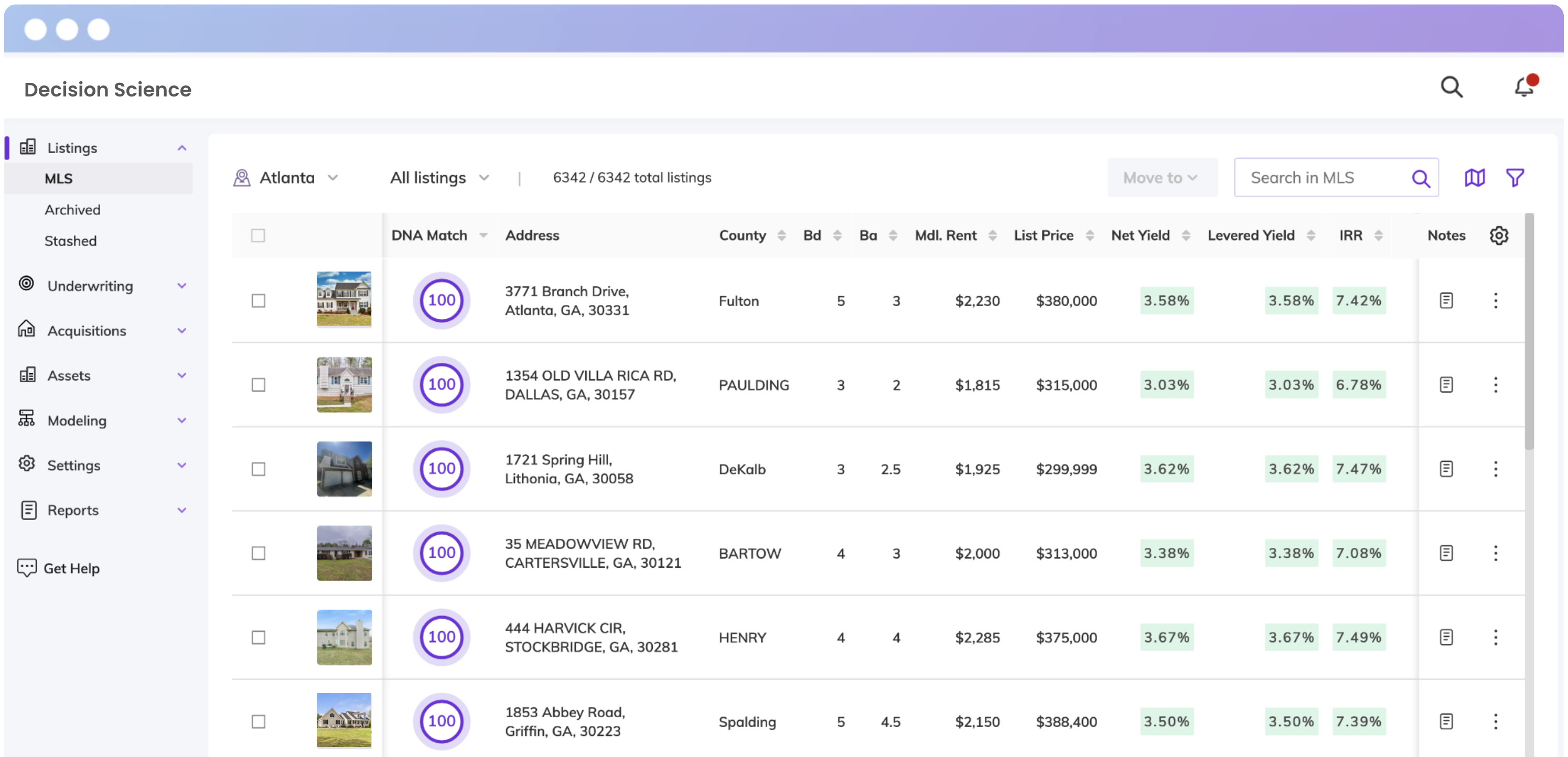

Built with advanced data science, institutional-quality automated modeling, machine learning, and local market data, Picket’s Decision Science platform helps investors acquire and manage SFR buildings across regions, providing a personalized experience based on each investor’s unique ’buy box’. This acquisition technology works to instantly identify listings on the multiple listing services (MLS) that fit users’ specific investment criteria, subsequently delivering custom return analyses for all of the potential assets identified. Beyond this platform, Picket offers a data-backed property management software that fuels cross-market efficiency and automation to create a better renting and living experience.

Through these integrated tech solutions, SFR owners and operators are given the necessary insights to improve quality-of-life for residents, accelerate portfolio growth, and streamline portfolio management. The company’s innovative technologies are supported by a seasoned team dedicated to upgrading the SFR rental process; together, these resources have powered the company’s explosive growth — annualized revenue has grown more than 35% month over month for each of the last 12 months and exceeded 50% month-over-month growth over the last six. The demand for tech that strengthens the investment and management of SFR assets for institutional players is clear, and Picket has emerged as the leading solution.

An Informed Future for SFR Investment

Our investment in Picket comes amidst a tangible market shift driving an influx of institutional capital into the SFR sector. The firm is uniquely and strategically positioned to support this transition and improve the SFR experience for all stakeholders by immediately identifying key opportunities and risks through a data-backed process.

We are eager to work in partnership with the Picket team to offer and expand upon this revolutionary solution for top SFR operations, and we are confident in the platform’s potential to create major efficiencies for the entire industry.