The Emergence of Insurtech

Over the last decade, the $1.3-trillion U.S. insurance industry has become a focal point for venture capital, driving emerging disruptors to bring sorely needed innovation to the space.

”Insurtech” has already produced major success stories, with billion-dollar valuations and public exits for names such as Lemonade and Hippo, which leverage technology to power a step-change in the ease of access for the average consumer to secure and manage their basic insurance needs. With the early success of these first movers, the insurtech market has accelerated in kind, to an estimated $2.72 billion in 2020.

Insurtech Meets Rent Tech

Insurance is a critical category for RET and our Strategic Investors, comprising a group of enterprise-scale residential real estate owners and operators representing ~2.4m units of multifamily and single-family rental inventory. We have been monitoring the growth in this sector for years, tracking the emergence of various solutions focused on renters and multifamily owner-operators. We announced our formal entry into the sector earlier this month, leading a $7 million Series A funding round for Get Covered.

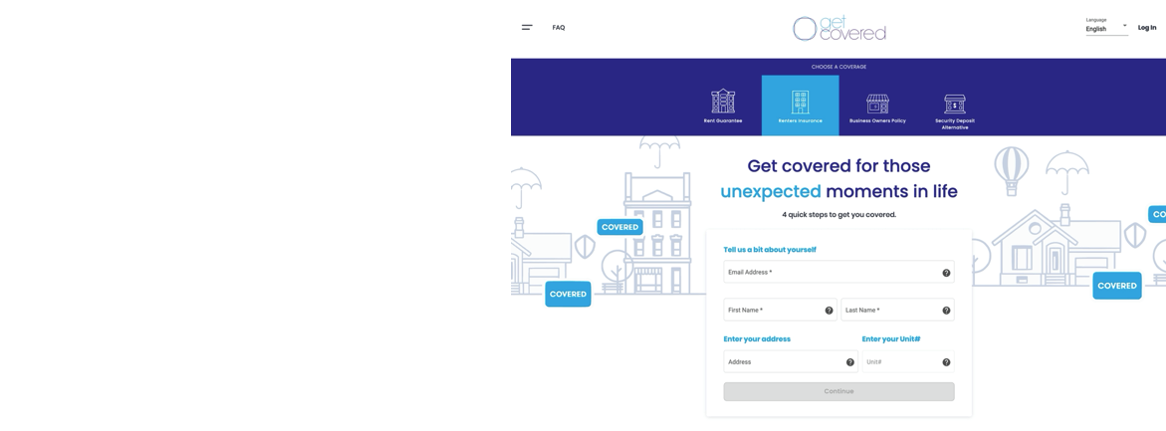

Through an easy-to-use interface, Get Covered streamlines the purchase and tracking of every form of renter-related insurance, including renters’ insurance, master liability programs, security deposit alternatives, and other risk management products.

Our partnership with Get Covered marks RET’s first standalone insurtech investment – one that follows a deliberate, extended process to identify a solution that best solves the pain points our Strategic Investors experience as enterprise scale owner-operators.

Proven Value for Rental Communities

Renter’s insurance is largely a commodity product in a market crowded with both traditional and tech-enabled offerings. Recognizing this, Get Covered has been built from the ground up to differentiate itself by providing a better insurance operating system to connect all stakeholders in the value chain, mastering the complex relationship between owner-operators, property managers, and residents. While other tech-enabled solutions offer a single or small number of products, often directly to consumers, the Get Covered team has built a platform that offers a comprehensive, flexible suite of insurance products and an API integration that allows for seamless and near-instant implementation into existing property management systems.

Get Covered’s unique approach allows operators to accurately, comprehensively, and efficiently track resident compliance with a community’s minimum required policy for the first time and automatically tracks coverage throughout the term of the lease.

With the help of our Strategic Investors, we spent significant time test-driving Get Covered, building conviction that the platform addresses the systemic weaknesses in the resident-insurance ecosystem. With a new round of funding in hand, Get Covered will be able to drive more efficient and transparent adoption of insurance at multifamily properties across the country – offering tangible benefits not only to residents but owners and property managers as well.

Insurtech & Real Estate: Early Innings

Get Covered represents RET’s first insurtech investment, and it will not be our last. As we continue our work to build a better tech stack for the real estate sector, we expect to identify additional pain points at the intersection of insurance and real estate. We see potential examples in the property and casualty sector, as well as with legacy insurance carriers that own large portfolios of real assets, or elsewhere in the industry value chain.

We could not be more excited to partner with Get Covered and to enter a new area of real estate technology that holds so much potential for our partners.